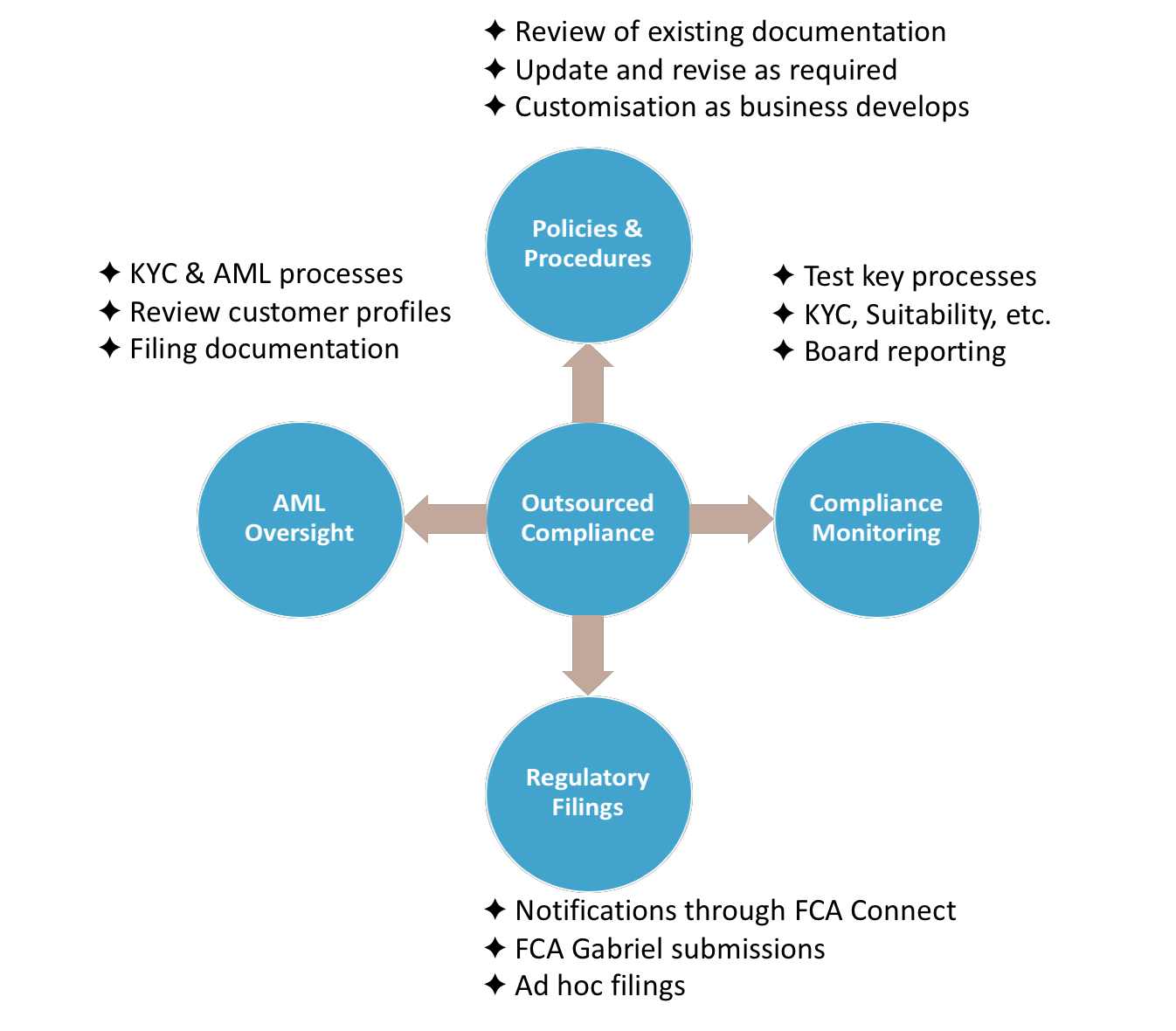

RiskSave Compliance can provide a complete outsourced compliance service to businesses old and new. From advice on policy design and documentation, to the day-to-day monitoring of key regulatory processes, RiskSave can customise a service to your needs.

Policies & Procedures

RiskSave will work with you to review your existing documentation or to design a completely new set of policies and procedures to be used at the firm. This can include your compliance manual, AML/CTF procedures, suitability assessments, Pillar 3 disclosures and ICARA & liquidity statements, as well as any other documentation that are appropriate to your business.

Compliance Monitoring

We can design and implement a full compliance monitoring service including testing your key regulatory processes such as CDD, financial promotions, best execution, suitability assessments, personal account dealing, etc. Monitoring will be conducted at an appropriate frequency with reporting on findings to the Board

Regulatory Filings

We can take over responsibility for all regular and ad hoc interactions with the FCA including regulatory notices through the FCA Connect system. We can also liaise with your accounting function to ensure that the crucial regulatory filings through FCA Gabriel are made accurately and on time.

AML Oversight

While the responsibility for complying with AML/CTF legislation will still rely with the firm, RiskSave can undertake the daily processes of ensuring compliance, as well as the periodic review of customer files to ensure that profiles are kept up to date.

General Compliance Guidance

With a deep understanding of the regulatory environment, RiskSave will be your goto source for advice during new business development or product design. We can ensure that your staff are kept up to date and appropriately trained to ensure good outcomes for your customers and compliance with the Training and Competency rules.